Discover powerful customer retention statistics that will reshape your strategy. Learn key insights on loyalty, profit, and growth for 2025.

In This Article

Subscribe to our newsletter

In the race to acquire new customers, many businesses overlook a more profitable strategy: keeping the ones they already have. While acquisition feels like growth, true, sustainable success is built on a foundation of loyalty. The data is clear-focusing on retention isn't just a feel-good strategy; it's a powerful economic driver with an ROI that acquisition can rarely match. Understanding the key customer retention statistics is the first step toward building a more resilient and profitable business model.

This is more than just a list of numbers; it's a strategic guide for publishers, marketers, and e-commerce teams. Each statistic unpacks a core truth about customer behavior, providing actionable insights to help you reduce churn, increase lifetime value, and turn your existing audience into your most effective growth engine. To truly understand the power of retention, it's crucial to delve into how to measure customer loyalty and retention metrics that provide these actionable insights.

For publishers, this means fostering a loyal readership that consumes more content, engages more deeply, and ultimately drives subscription and ad revenue. For marketers, it means identifying the moments that matter most in the customer journey and capitalizing on them to build lasting relationships. The following data points will not only highlight the importance of customer retention but also provide a clear roadmap for implementing strategies that work. Let's dive into the statistics that will define your retention strategy and transform your bottom line.

1. A 5% Increase in Retention Can Boost Profits by 25-95%

This foundational statistic from Bain & Company, first published in the Harvard Business Review, is arguably the most critical of all customer retention statistics. It establishes a powerful, non-linear relationship between keeping customers and growing your bottom line. The principle is that a small improvement in retention rates creates a disproportionately large impact on profitability, making it a high-leverage focus for any business.

The wide range, from 25% to 95%, depends on the industry's cost structure and customer lifecycle value. For publishers and media companies, where the initial cost to acquire a subscriber or registered user is high, this effect is particularly pronounced.

How It Works: The Compounding Value of a Loyal Customer

The profit boost isn't a one-time event; it's a compounding force driven by several factors that build over time. A retained customer becomes more valuable with each interaction.

- Increased Purchase Frequency: Loyal customers buy more often. A subscriber who renews for a third year has demonstrated a consistent need for your content.

- Lower Service Costs: Long-term customers are familiar with your platform, products, and services. This leads to fewer support tickets and service inquiries, reducing operational overhead.

- Reduced Price Sensitivity: Customers who trust your brand are less likely to be swayed by competitor discounts. They value the quality and consistency you provide over a small price difference.

- Powerful Referrals: Happy, long-term customers become your most effective marketing channel. Their word-of-mouth recommendations are more trusted than traditional advertising and come at zero cost.

Key Insight: The economics of retention shift from a high-cost acquisition model to a low-cost, high-profit nurturing model. Each renewed subscription or repeat purchase adds almost pure profit, as the initial acquisition cost has long been paid off.

Actionable Strategy: Implement a Proactive Onboarding Sequence

To capitalize on this principle, focus on the critical first 90 days of a new subscriber or user relationship. A strong onboarding process can significantly improve long-term retention.

Example for a Publisher:A news media outlet can create an automated email sequence for new digital subscribers.

- Day 1: A welcome email from the editor-in-chief, highlighting the value of their journalism.

- Day 7: An email showcasing how to use key platform features, like saving articles, managing newsletters, and using the mobile app.

- Day 30: A survey asking for feedback on their experience so far, making them feel heard and valued.

- Day 60: A personalized email recommending content based on their reading history, demonstrating the platform’s intelligence.

This proactive engagement solidifies the user's decision and integrates the product into their daily routine, making them far more likely to stick around long enough to deliver that powerful profit boost.

2. Acquiring New Customers Costs 5-25x More Than Retention

This foundational business principle, widely cited by sources like the Harvard Business Review, highlights the stark economic disparity between attracting new customers and retaining existing ones. The core idea is that the resources, effort, and capital required to find, persuade, and convert a new prospect are dramatically higher than those needed to keep a current customer satisfied and engaged. This makes retention one of the most efficient growth levers available.

The 5x to 25x range is broad because it is highly dependent on the industry, business model, and market competition. For B2B software companies or specialized media outlets with a niche audience, the cost to acquire a qualified lead can be immense, placing them at the higher end of this spectrum.

How It Works: The Front-Loaded Costs of Acquisition

The high cost of acquisition is driven by the significant upfront investment required to capture someone's attention in a crowded market. These costs are incurred long before any revenue is generated.

- Marketing and Advertising Spend: This includes everything from paid search and social media ads to content marketing and trade show sponsorships. You are paying just for the chance to be seen.

- Sales and Personnel Costs: The salaries and commissions for sales teams, business development representatives, and marketers are a major component of customer acquisition cost (CAC).

- Onboarding and Setup Friction: New customers often require intensive support, training, and setup to get started, consuming significant company resources.

- Introductory Offers and Discounts: Many businesses use steep discounts to lure in new customers, which directly cuts into the initial profit margin of that relationship.

Key Insight: Customer acquisition is an expensive, speculative investment. Customer retention, in contrast, is about maximizing the return on an investment you have already made. Shifting focus to retention immediately improves capital efficiency and profitability.

Actionable Strategy: Calculate and Leverage Your Cost-to-Serve Ratio

To make this statistic actionable, you must first understand your own numbers. Calculate your Customer Acquisition Cost (CAC) and compare it to the cost of retaining a customer. Once you have this ratio, you can justify strategic investments in retention.

Example for a Media Company:A specialized financial news service determines its CAC is $450 (including ad spend and sales commissions). In contrast, the annual cost to retain a subscriber is just $50 (covering customer success check-ins, exclusive content, and automated renewal campaigns). This gives them a 9x ratio.

- Justify a Customer Success Team: With a 9x cost difference, the company can easily justify hiring a customer success manager. If that manager prevents just a handful of customers from churning each month, the role pays for itself many times over.

- Invest in Community Features: They could use this data to greenlight a project for a premium subscriber-only forum or Slack channel. The cost of building and maintaining the community is minimal compared to the cost of replacing the subscribers it helps retain.

- Prioritize High-Value Segments: The company can focus its retention efforts on enterprise accounts, where the cost to acquire a replacement would be even higher, ensuring maximum ROI.

3. 68% of Customers Leave Due to Perceived Indifference

While product features and pricing are important, this staggering statistic reveals the true silent killer of customer loyalty: apathy. Research popularized by sources like the Rockefeller Corporation shows that nearly seven out of ten customers who churn do so simply because they believe the business doesn't care about them. This isn't about a single bad experience; it's about a cumulative feeling of being ignored, undervalued, and treated like a number.

This finding is a cornerstone of modern customer retention, shifting the focus from transactional metrics to relational ones. It underscores that the emotional connection a customer has with a brand is often more powerful than the functional benefits they receive. For publishers, this means a subscriber's feeling of belonging to a community can be as crucial as the quality of the journalism itself.

How It Works: The Emotional Bank Account

Every interaction with a customer is either a deposit into or a withdrawal from an "emotional bank account." A personalized email, a helpful support agent, or a proactive content recommendation are all deposits. A generic, irrelevant marketing blast, a slow response to a query, or a buggy app experience are withdrawals. When the balance drops too low, the customer perceives indifference and leaves.

- Recognition and Personalization: Customers stay when they feel seen. Using their name, referencing their history, and tailoring recommendations shows you are paying attention.

- Proactive Problem Solving: Reaching out to a user who seems disengaged or had a failed payment shows you care about keeping their business, preventing churn before it happens.

- Empowerment of Frontline Staff: When a customer service agent can solve a problem without escalating it, it sends a powerful message that the company trusts its employees to do right by the customer. Zappos built its empire on this principle.

- Consistent Feedback Loops: Actively soliciting and acting on feedback demonstrates that you value the customer's opinion, turning them into a partner in improving the service.

Key Insight: Customer churn is often an emotional decision disguised as a logical one. A customer might cite "price" as the reason for leaving, but the real trigger was the feeling that they weren't valued enough to justify that price.

Actionable Strategy: Implement a Customer Sentiment Tracking Program

To combat indifference, you must first be able to measure it. Go beyond traditional KPIs like engagement and page views by implementing a system to track customer sentiment.

Example for a Media Company:Integrate simple, one-click feedback tools directly into your content and communication channels.

- At the end of an article: "Did you find this article helpful? 👍 / 👎"

- In a weekly newsletter: "How are we doing this week? ⭐⭐⭐⭐⭐" Use engaging email marketing best practices to maximize response rates. Discover more about building engagement through email marketing.

- After a support interaction: A simple Net Promoter Score (NPS) or Customer Satisfaction (CSAT) survey.

- In-app pop-up: For a disengaged user, "We've missed you! What can we do to make your experience better?"

By collecting this data, you can create a "health score" for each customer. When a score dips below a certain threshold, it can trigger an automated or manual intervention, such as a personalized email from a community manager or a special offer, directly addressing the perceived indifference before it leads to churn.

4. Repeat Customers Spend 67% More Than New Customers

While acquisition often gets the spotlight, this statistic from various industry studies, including those by Adobe and Invesp, reveals the true financial engine of a business: its existing customer base. The core finding is that a customer who has already purchased from you is primed to spend significantly more in subsequent transactions than a brand-new buyer. This isn't just about repeat business; it's about escalating value over time.

This spending increase is rooted in trust and familiarity. Once a customer has had a positive initial experience, the perceived risk of making a larger purchase or trying a new product line diminishes. This is one of the most powerful customer retention statistics because it directly ties loyalty to increased revenue per customer, not just continued patronage.

How It Works: The Escalation of Trust and Value

A customer's journey from a single purchase to becoming a high-value loyalist is a predictable progression. Their increased spending is a direct result of successfully building a relationship.

- Overcoming Initial Hesitation: The first purchase is the biggest hurdle. Once crossed, customers are more comfortable making larger investments, whether it’s upgrading a subscription or buying a premium product.

- Greater Product Exploration: Repeat customers trust your brand's quality. They are more likely to explore ancillary products, like merchandise from a media brand or special-edition content, because they already believe in the core offering.

- Higher Average Order Value (AOV): Established customers often bundle purchases or select higher-tier options. For a publisher, this could mean buying an annual subscription plus a ticket to a live event.

- Responsiveness to Upsells: A loyal customer who understands your value proposition is more receptive to personalized upsells and cross-sells that genuinely meet their needs.

Key Insight: The value of retention isn't just in preventing churn; it's in cultivating a customer base that actively seeks to spend more with you. Their confidence in your brand directly translates to a higher Customer Lifetime Value (CLV).

Actionable Strategy: Implement a Tiered Loyalty Program

To encourage this increased spending, create a system that explicitly rewards customers for their continued business and higher engagement. A tiered loyalty program is a perfect vehicle for this.

Example for a Publisher or E-commerce Site:A media company with an e-commerce store could create a "Press Club" loyalty program.

- Tier 1 (Insider): Achieved after the first purchase or subscription. Benefits include a 5% discount and early access to new articles.

- Tier 2 (Advocate): Achieved after spending $250 or 1 year of continuous subscription. Benefits increase to a 10% discount, free shipping on all merchandise, and exclusive Q&A sessions with journalists.

- Tier 3 (Patron): Achieved after spending $750. Benefits include all of the above plus a 15% discount, a yearly thank-you gift, and an invitation to an annual VIP event.

This structure gamifies loyalty and provides clear, tangible incentives for customers to deepen their financial relationship with your brand. By nurturing these repeat buyers, you can significantly enhance your e-commerce conversion rates and overall revenue. You can learn more about proven e-commerce conversion tactics on project-aeon.com.

5. Customer Lifetime Value Increases by 300-500% for Highly Engaged Customers

While acquisition metrics often get the spotlight, this statistic from research by organizations like Gallup and Rosetta Consulting shifts the focus to a more profound driver of long-term success: emotional engagement. The finding reveals that fully engaged customers are not just slightly more valuable; they can deliver a staggering 300-500% increase in lifetime value. This makes engagement one of the most powerful levers for sustainable growth.

This highlights a critical distinction in the world of customer retention statistics: the difference between a transactional customer and a truly engaged one. An engaged customer invests emotionally in your brand, transforming their relationship from a simple exchange of goods for money into a partnership built on trust and shared values.

How It Works: The Economics of Emotional Connection

An engaged customer's value skyrockets because their behavior fundamentally changes. They move beyond simple purchasing patterns and become integrated into your brand's ecosystem, creating a powerful, self-reinforcing cycle of value.

- Increased Spend and Frequency: Engaged customers don't just stick around; they spend more. For example, Starbucks found that members of its rewards program who engaged with its mobile app visited 5.6 times more frequently.

- Brand Advocacy: These customers become voluntary brand ambassadors. Peloton's community-driven model is a prime example, where members encourage each other, share milestones, and recruit new users, fueling a 92% retention rate.

- Insulation from Competition: An emotional connection is much harder for a competitor to break than a transactional one. Engaged customers are less susceptible to price wars or promotional offers because they value the community and experience you provide.

- Valuable Feedback Loop: They are more likely to offer constructive feedback and participate in surveys, providing you with priceless insights to improve your products and services.

Key Insight: True retention isn't just about preventing churn; it's about fostering deep, emotional connections. The financial return on investing in community and engagement far surpasses the cost, creating a moat around your business that is difficult for competitors to cross.

Actionable Strategy: Build a Thriving Community Platform

To cultivate this level of engagement, you must provide a space for customers to connect with your brand and each other. Creating a dedicated community platform is a direct path to fostering these valuable relationships. For more ideas on this topic, you can learn more about modern audience engagement strategies.

Example for a Media Company:A niche streaming service focused on documentaries can build a community hub directly within its platform.

- Launch Discussion Forums: Create dedicated forums for each documentary, allowing viewers to discuss themes, share opinions, and connect with others who share their interests.

- Host Live Q&A Sessions: Organize exclusive live-streamed Q&A events with filmmakers and experts featured in the content. This provides direct, high-value interaction that users can't get elsewhere.

- Introduce User Profiles and Badges: Implement gamification by allowing users to create profiles, earn badges for watching series or participating in discussions, and follow other members.

- Feature User-Generated Content: Run a monthly "Viewer's Take" section where you highlight the most insightful or creative user comments and reviews from the community, making members feel seen and valued.

By building a space for shared experiences, you transform passive viewers into an active, engaged community that is far more likely to remain loyal for years to come.

6. 92% of Customers Trust Referrals from People They Know

This powerful statistic from Nielsen underscores a critical link between customer retention and acquisition: your most loyal customers are your most credible marketers. It highlights that the trust established with your existing audience can be directly converted into a powerful, low-cost growth engine. While many customer retention statistics focus inward on saving costs, this one proves that retention is also an offensive strategy for acquiring new, high-quality customers.

When a satisfied subscriber or reader recommends your content to a friend, that recommendation carries more weight than any paid advertisement. This creates a virtuous cycle where retaining one customer can lead to the acquisition of several more, amplifying the ROI of your retention efforts significantly.

How It Works: Turning Loyalty into Advocacy

The trust dynamic is simple: people trust people. A recommendation from a friend, family member, or respected colleague cuts through the noise of traditional marketing. It serves as a pre-vetted endorsement, reducing the perceived risk for the new customer and shortening their decision-making process.

- Authenticity and Credibility: A personal referral is seen as genuine and unbiased, unlike a branded message designed to sell.

- Higher Conversion Rates: Leads generated through referrals often have the highest conversion rates because they arrive with a baseline level of trust.

- Better Customer-Product Fit: Existing customers tend to refer people who share similar interests or needs, leading to new customers who are more likely to be a good fit and, in turn, become loyal themselves.

- Zero-Cost Marketing Channel: Word-of-mouth advocacy is a form of marketing that you don't pay for directly. It's an organic outcome of delivering an exceptional experience.

Key Insight: Customer retention and word-of-mouth marketing are not separate functions; they are two sides of the same coin. A successful retention strategy naturally fuels an effective advocacy program, creating a self-sustaining growth loop.

Actionable Strategy: Formalize Your Referral Program

Don't just hope for referrals; actively encourage and reward them. By implementing a formal program, you can systematize this powerful growth channel.

Example for a Media Company:A niche B2B publication can create a "Give a Subscription, Get a Reward" program.

- The Offer: Current subscribers receive a unique sharing link. When a friend uses it to sign up for a paid annual subscription, the new subscriber gets their first month free, and the original subscriber receives a $25 gift card or credit toward their next renewal.

- Make it Easy: Integrate one-click sharing buttons within the user's account dashboard and at the end of popular articles, allowing them to share via email, social media, or a direct link.

- Track and Reward: Use referral marketing software to automatically track the source of new sign-ups and instantly deliver the rewards to both parties upon a successful conversion.

This approach transforms satisfied readers into an active, motivated sales force, proving that investing in your current audience is one of the smartest ways to find your next one.

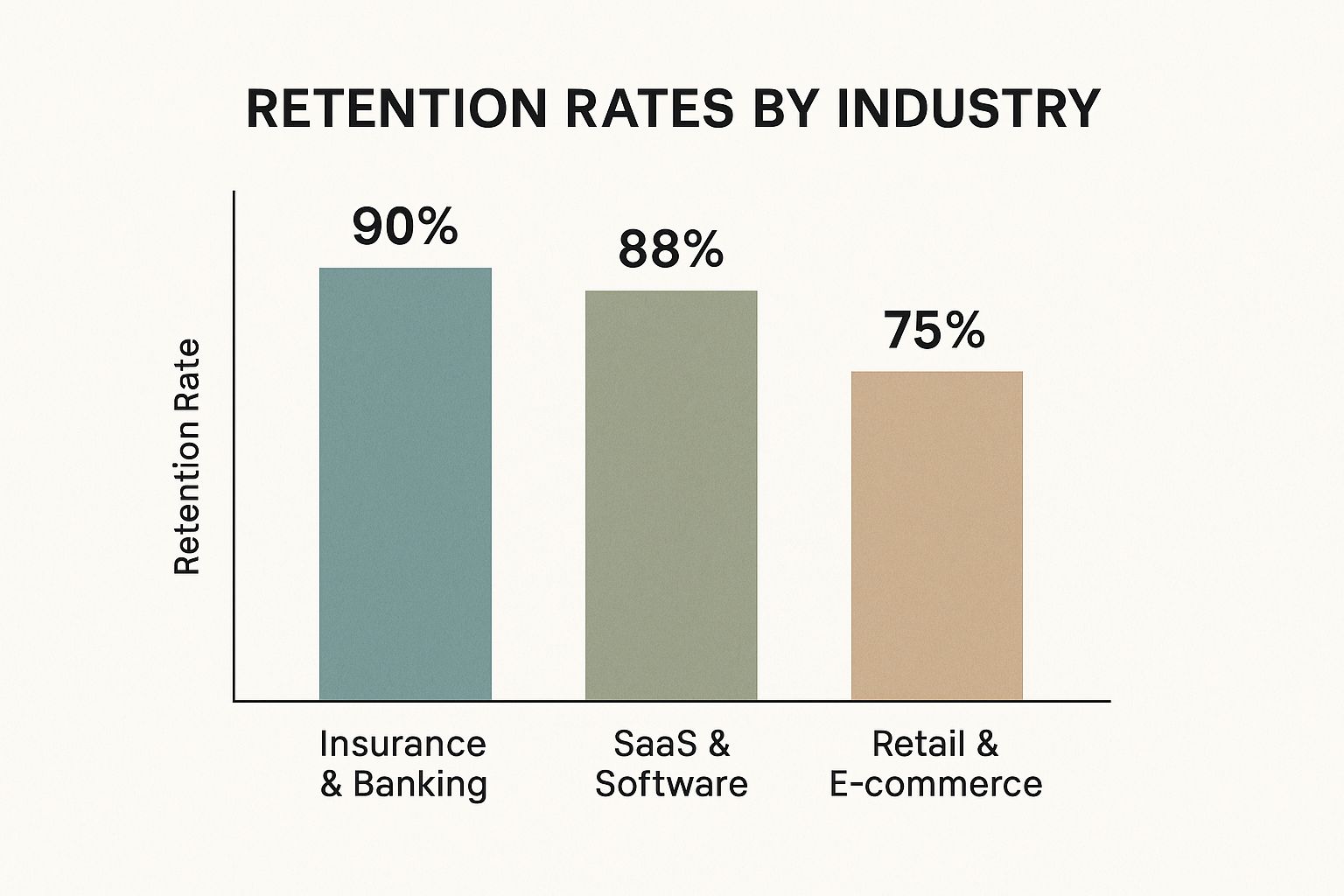

7. Customer Retention Rates Vary Dramatically by Industry: 70-90%

Not all industries are created equal when it comes to customer loyalty. This is a crucial one of the many customer retention statistics to understand, as data from sources like CustomerGauge and Mixpanel shows that average retention rates can swing from around 75% in retail to over 90% in sectors like insurance and banking. Knowing where your industry stands provides essential context for setting realistic goals and identifying opportunities.

This variation is driven by fundamental business model differences, such as switching costs, purchase frequency, and the depth of the customer relationship. For instance, changing your primary bank is a complex, high-friction process, leading to naturally higher retention. In contrast, switching between e-commerce stores is nearly effortless, demanding more proactive retention strategies from retailers.

How It Works: The Impact of Industry Dynamics

The structural characteristics of an industry create a baseline for customer churn. Understanding these factors helps you diagnose your own performance and borrow strategies from sectors that excel at retention.

- High Switching Costs: Industries like banking, insurance, and enterprise SaaS benefit from high barriers to exit. The effort required to migrate data, retrain teams, or change financial details makes customers think twice before leaving.

- Contractual Obligations: Subscription-based models, common in media and software, lock in customers for a set period. The key is convincing them to renew when that period ends. Costco achieves a 90% membership renewal rate because its value proposition is locked into an annual fee.

- Deep Integration: When a product is deeply embedded in a customer's daily life or business operations, it becomes indispensable. American Express retains over 90% of its cardholders by offering premium service, rewards, and a status symbol that integrates into their lifestyle.

This bar chart visualizes the significant difference in average customer retention rates across key industries.

The visualization clearly shows that industries with higher switching costs and deeper integration, like Insurance and SaaS, enjoy much higher baseline retention than more transactional sectors like Retail.

Key Insight: Your industry benchmark is a starting point, not a limit. While a media company might not reach a 90% rate like a bank, studying how high-retention industries create "stickiness" can reveal powerful, transferable strategies.

Actionable Strategy: Benchmark and Borrow from the Best

Use industry benchmarks to set an informed, progressive retention strategy. Instead of chasing a generic number, aim to outperform your specific market by adopting tactics from top-performing sectors.

Example for a Media Company:A niche streaming service faces churn similar to the retail industry (around 75%) because subscribers can easily switch. To improve this, they can borrow a strategy from the high-retention SaaS industry: deepening platform integration.

- Introduce User Profiles: Allow multiple users per household with individual watch histories and recommendations, making the service essential for the whole family (increasing switching costs).

- Create "Watch Lists" and "Collections": Encourage users to build a personal library of content they plan to watch. This investment of time and effort creates a sense of ownership, making them less likely to churn.

- Offer Offline Downloads: By allowing users to download content to their devices, the service becomes integrated into their travel and commute routines, increasing its daily utility.

This approach manufactures the "stickiness" that other industries enjoy naturally, helping a media publisher push its retention rate above the industry average.

8. Customers Who Engage with Customer Service are 3x More Likely to be Retained

This powerful statistic, supported by research from sources like Salesforce and Zendesk, flips the conventional view of customer service on its head. Instead of seeing support interactions as a cost center for fixing problems, savvy businesses view them as a prime retention opportunity. A customer who reaches out, even with a complaint, is giving you a chance to prove your commitment. Solving their problem effectively can build more trust and loyalty than if they had never experienced an issue at all.

This counterintuitive finding underscores a critical truth: silence is not golden. A customer who never contacts you might be perfectly happy, or they might be quietly dissatisfied and on the verge of churning. An engaged customer, however, is invested enough to seek a solution, presenting a golden opportunity to strengthen the relationship. This is one of the most transformative customer retention statistics for reshaping a company's support philosophy.

How It Works: Turning Problems into Loyalty Pivots

Effective problem resolution doesn't just fix an issue; it validates the customer's decision to choose your brand. When a company handles a complaint with speed, empathy, and efficiency, it demonstrates that it values its customers beyond the initial transaction. This creates a powerful emotional connection.

- Demonstrates Commitment: Solving a problem proves you stand behind your product and are committed to the customer's success.

- Builds Deeper Trust: A positive service experience can erase previous doubts and build a foundation of trust that is stronger than before the issue arose.

- Provides Valuable Feedback: Each interaction is a rich source of data, offering direct insight into user pain points, product flaws, or communication gaps that can be fixed to prevent future churn.

- Humanizes the Brand: A great service interaction with a helpful agent puts a human face on the company, making the brand feel more approachable and caring.

Key Insight: A customer service ticket is not a failure; it's a conversation. It's a critical moment of truth where a customer's frustration can be transformed into long-term advocacy, making your support team a key driver of retention.

Actionable Strategy: Train Service Teams for Relationship Building

Empower your customer service team to move beyond just closing tickets. Train them to be retention specialists who see every interaction as a chance to build a relationship.

Example for a Media Company:A subscriber contacts support because they are having trouble accessing premium content they paid for.

- Standard Response: The agent troubleshoots the technical issue and confirms access is restored. The ticket is closed.

- Retention-Focused Response: The agent quickly resolves the access issue. Then, they go a step further: "I’m so sorry you had trouble accessing the content you paid for. To make up for the frustration, I've added a complimentary one-month extension to your subscription. While I have you, I noticed you enjoy our investigative reports. Did you know you can follow that topic to get alerts when a new story is published?"

This approach not only solves the problem but also acknowledges the customer’s frustration, offers a tangible gesture of goodwill, and proactively helps them get more value from their subscription, dramatically increasing their likelihood of renewing.

Customer Retention Stats Comparison

| Item Title | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| 5% Increase in Retention = 25-95% Profit Boost | Moderate - requires org-wide changes | Medium - consistent multi-touchpoint effort | High - large profit increase over time | Companies seeking sustainable profit growth | Massive ROI from small improvements |

| Acquiring New Customers Costs 5-25x More Than Retention | Low to Moderate - cost analysis needed | Medium - investments in sales & marketing | Immediate cost savings and ROI benchmarks | Businesses optimizing resource allocation | Clear financial justification for retention focus |

| 68% of Customers Leave Due to Perceived Indifference | High - needs cultural & process shifts | Medium to High - staff training & engagement | Medium - gradual improvement in retention | Firms wanting to improve emotional customer bond | Low-cost fixes with strong differentiation potential |

| Repeat Customers Spend 67% More Than New Customers | Moderate - loyalty programs and personalization | Medium - marketing & data-driven efforts | High - increased average order value and loyalty | Retailers and e-commerce with repeat buyers | More predictable and higher revenue per customer |

| Customer Lifetime Value Increases 300-500% for Engaged | High - complex engagement strategies | High - personalized, scalable engagement | Very High - substantial lifetime value growth | Brands focusing on deep emotional relationships | Sustainable competitive moats and brand advocacy |

| 92% of Customers Trust Referrals from People They Know | Low - referral programs and incentives | Low to Medium - incentives and digital tools | High - strong acquisition and retention synergy | Businesses leveraging word-of-mouth and advocacy | Highest conversion and trust among marketing channels |

| Customer Retention Rates Vary Dramatically by Industry | Low - benchmarking and analysis | Low - mainly research and strategy setting | Contextual - helps set realistic goals | Companies benchmarking retention performance | Industry-specific realistic retention targets |

| Customers Who Engage with Customer Service 3x More Likely | Moderate - service training and tools | Medium to High - quality service investments | High - improved loyalty through problem resolution | Service-centric businesses focusing on retention | Turns service encounters into loyalty opportunities |

From Statistics to Strategy: The Future is Retained

The journey through these foundational customer retention statistics reveals a powerful, data-backed truth: sustainable business growth is not just about attracting new eyes; it's about earning the continued loyalty of the audience you already have. The numbers we've explored are more than just interesting data points; they are strategic signposts pointing toward greater profitability, stronger brand equity, and a more resilient business model. They dismantle the myth that endless acquisition is the only path to success.

From the staggering 25-95% profit boost driven by a mere 5% increase in retention to the fact that repeat customers spend 67% more, the evidence is overwhelming. Ignoring the post-acquisition journey is no longer a viable option. It's an active decision to leave significant revenue and brand stability on the table. The most telling insight, perhaps, is that 68% of customers leave not because of price or product failure, but due to a feeling of indifference. This puts the power squarely back in your hands. Loyalty isn't lost in grand failures; it's eroded by quiet neglect.

Turning Insights into Actionable Strategy

Understanding these statistics is the first step, but translating them into tangible results requires a strategic shift from passive observation to active engagement. The goal is to operationalize retention, embedding it into your daily workflows and company culture. This means moving beyond simply tracking metrics and starting to architect experiences that give customers a reason to stay.

Here are the core takeaways to transform your approach:

- Prioritize Proactive Engagement: Don't wait for a customer to signal they are unhappy or at risk of churning. The data on perceived indifference is a clear mandate to be proactive. Develop automated yet personalized touchpoints, such as check-in emails, personalized content recommendations, or exclusive access to new features, to show you value their business beyond the initial transaction.

- Invest in Customer Service as a Retention Engine: View your customer service team not as a cost center, but as a high-impact retention department. The statistic that customers who engage with support are three times more likely to be retained highlights this. Equip your team with the tools and autonomy to solve problems effectively and create positive, memorable interactions that reinforce a customer’s decision to choose you.

- Systematize the Referral Process: With 92% of consumers trusting referrals from people they know, word-of-mouth is your most potent marketing channel. Don't leave this to chance. Implement a formal referral program that makes it easy and rewarding for loyal customers to become brand advocates. Offer incentives like discounts, credits, or exclusive content for successful referrals.

Bridging the Gap Between Data and Execution

Knowing that you need to improve retention and actually doing it are two different challenges. The key is to bridge this gap with scalable processes and effective tools that don't overwhelm your teams. To transition from understanding these statistics to implementing effective solutions, a detailed guide on how to reduce churn rate can provide actionable steps. Building a retention-focused strategy is an ongoing process of testing, learning, and optimizing based on your unique audience and industry benchmarks.

Ultimately, mastering customer retention is about building genuine, lasting relationships at scale. The customer retention statistics we've covered provide the "why," but your strategy provides the "how." By focusing on delivering consistent value, showing genuine appreciation, and making every interaction count, you can build a loyal customer base that not only drives revenue but also becomes your most powerful growth asset. The future of your business isn't just acquired; it's retained.

Ready to turn these customer retention statistics into your most powerful strategy? Aeon helps you automate the creation of personalized, high-impact videos that fight customer indifference and build lasting loyalty at scale. Discover how you can engage, educate, and retain your audience with video by exploring Aeon today.

.jpg)